Key Takeaways

1. IRS form W-4 enables employers to determine worker income tax withholdings based on earnings, life factors, and filing status.

2. Employers request W-4 forms to be completed by all direct-hire employees and H1Bi status non-resident aliens.

3. Employees are responsible for filling out a new W-4 if they need to update or correct their information.

4. Information included on a W-4 form serves as the basis of annual W-2 tax withholdings.

In the United States, hiring managers have many responsibilities when processing new hires. An important aspect of this process is obtaining a completed W-4 form from all U.S. based employees and H1B1 (visa-holding) workers. Along with other documentation, the W-4 form is required by the government to properly determine income taxes to be withheld for each employee.

Want to learn more? Here’s a rundown of the key elements of the W-4 (W4) form, information needed to fill it out, and the main legal questions for all

What Is a W-4 Form?

A W-4 form, officially called the Employee’s Withholding Allowance Certificate, is a document that the Internal Revenue Service (IRS) requires all U.S. employees and non-resident aliens (H1B1) to complete for income tax withholding. This form is issued by the IRS and is regularly updated so that employees have access to the most recent format.

The entire W-4 form includes a one-page sheet to be completed by the employee and a set of worksheets to assist the employee with determining the proper amount of tax credits they are eligible to claim – which will determine their tax liability.

What Is the Purpose of the W-4 Form?

The purpose of a W-4 form is for U.S. employees to indicate the amount of tax allowances and credits that they may claim, so that the employer can calculate the correct tax withholding from their paychecks. Income tax and tax credits are based on filing status, the employee’s annual income, number of dependents, and any additional withholdings they’d like to request.

The W-4 also includes information that the employer needs to file a W-2 for the tax year.

Where to Find a W-4 Form

The most up-to-date blank W-4 form can be found on the IRS website. Employers can also request W-4s by calling 800-TAX-FORM. It can be filled out electronically and submitted as a digital document, or printed out on paper to be scanned by the employer before sending it to the IRS.

Additionally, an authorized third-party payroll provider or recruitment agency can supply employees with a current W-4 form.

How to Complete an IRS W-4 Form

It is critical to understand how to educate employees how to properly complete a W-4 form. Since it determines the tax to be withheld from their paychecks, all employers must understand how and what needs to be completed on the W-4 form.

Pay attention to the tips below:

Information included on the W-4

The information that needs to be included on the W-4 form is not at all complicated. Much of the information can be located by the employee with support from the employer or the payroll provider.

The information required on a W-4 includes:

1. Employee Identification

- Employee’s first and last name

- Employee’s Social Security number

- Employee’s street address, city/town, state and zip code

- Signature and date the W-4 form was completed

2. Wages and Taxes

- Employee’s federal income tax filing status

- Multiple jobs or indication of spousal income

- Dependent credit(s) calculation

- Other non-work income, deductions or withholdings

3. Employer Information (to be completed by employer)

- Employer’s name and address

- Employee’s first date of employment

- Employer’s federal Employer Identification Number (EIN)

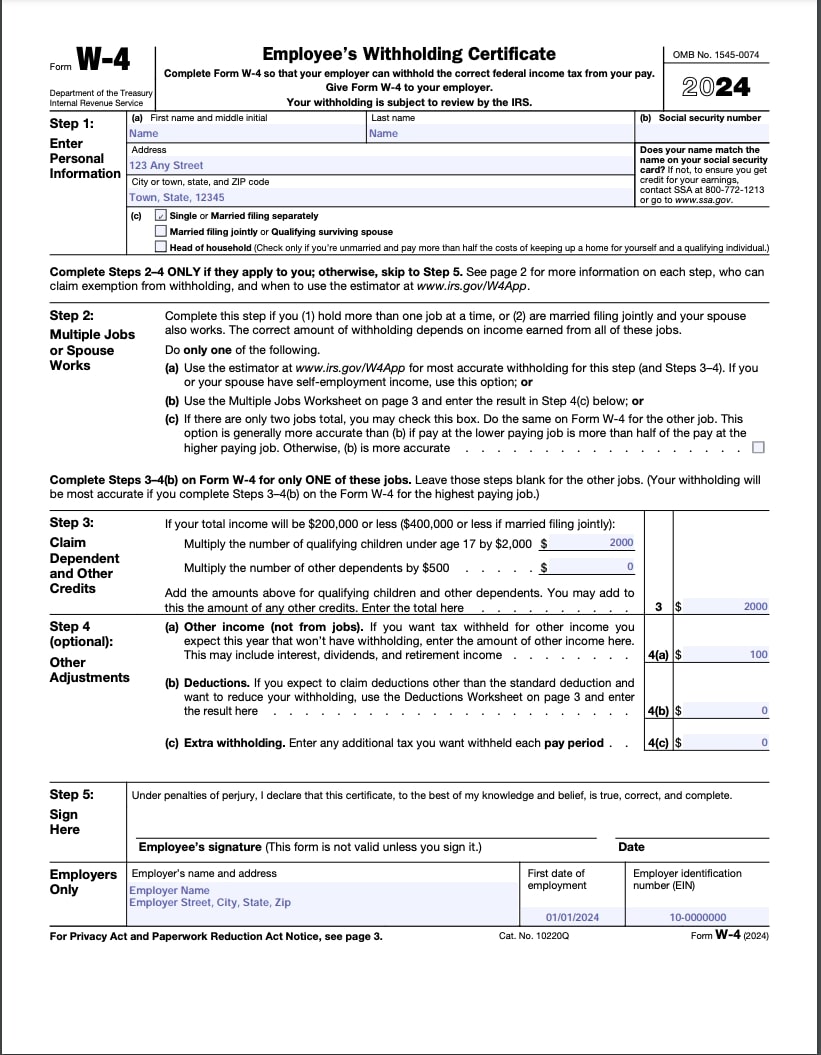

Example of a completed W-4 form

While each form will be completed using individual information, here is an example of a completed W-4 form:

Example of Completed IRS Tax Form W-4

4. Making Changes, Updates, and Correcting Errors

It’s possible that an employee or employer may make mistakes when completing the IRS form W-4.

In other cases, income or employee personal information must be updated. If this is required, the IRS has a simple process for updating, making qualified life changes, and correcting errors made on a W-4.

- Step 1. Complete a new W-4 form for the current tax year.

- Step 2. Employer must update the employee payroll record to ensure accuracy.

Using Third Party Services to Complete W-4s

In order to save time and be compliant with U.S. tax requirements, many employers choose to outsource this task to a third-party payroll or employment support provider. This can be a convenient way to ensure an organization is managing employee hiring and payroll duties correctly, while reducing risk of IRS penalties.

What Employers Do with the W-4 Form

In addition to the requested information to complete an IRS W-4 form, there are other requirements that employers must take care of. Timely processing of the W-4 ensures that the employer is in compliance with IRS rules and employees are assessed the correct amount of income taxes. Failure to calculate the right tax amount can result in an underpayment of taxes, which means the employee must pay additional taxes at the end of the year.

1. Employer Must Furnish the W-4 Form at Hire

First and foremost, every U.S. based employer or employer hiring employees in the U.S. must furnish the latest W-4 form to new hires. This form is available on the IRS website and can be completed online or as a paper format. Thai W-4 form must be provided on the employee’s first day of employment and returned to the employer within 3 business days.

2. Employer Reviews the W-4 Form

Because employees fill out the W-4 at hire, provide tax withholdings, addresses, marital status, and more when needed, employers have the responsibility of reviewing it for completion. If they note any mistakes, missing information, or other concerns they should promptly alert the employee and have them correct and share this information on a new W-4 form.

3. Validity of the W-4 Form

According to the IRS, a W-4 form is valid only for the calendar year in which it is completed by the employee and returned to the employer. In order to continue to be exempt from any tax withholding or be eligible for tax credits, the employee must complete a new W-4 anytime there is a change in their status and employers must update their payroll systems by February 15th of each tax year.

4. W-4 Form Deadlines

IRS deadlines for the W-4 are very important to understand. Employees must return a completed W-4 form before their first pay period. This verifies their information so that employers can withhold the correct income tax.

Employers are required to implement the W-4 deductions within 30 days after the employee’s start date. Each year, employers must also have employees complete a new W-4 form with updated information by February 15th for the tax year.

5. W-4 Information Storage and Security

Employers must retain employee W-4s for four years from the last day of the fourth-quarter of the year, for IRS and tax auditing purposes. After that, W-4s that are older than four years may be securely shredded and disposed of.

A paper format may be stored in the employee file, securely locked in a cabinet. It is recommended that W-4s and other IRS forms retained should be stored in a secure human resource information system (HRIS) in an encrypted digital format.

When responding to IRS requests for W-4 forms, it is advised to use their electronic filing process instead of mailing or emailing the document.

W-4 Form Legal Updates

The present IRS W-4 is based on the 2018 Tax Cuts and Jobs Act (TCJA), which did away with the former way that tax allowances were credited. It also supported reductions of individual, corporate, and estate tax rates. The W-4 form used (as of this writing) is in effect from tax years 2017 to 2025.

Be sure to check the IRS website often for important updates to income tax laws.

Special W-4 Forms

It is important to note that a W-4 is not required for independent contractors or self-employed individuals. Resident aliens with H1B1 status also provide additional documentation when completing their W-4.

The special forms used are listed with instructions as indicated:

Non-resident alien

Complete a W-4, check non-resident alien tax status, and include IRS form 8233.

Independent contractors and self-employed individuals

Complete an IRS form W-9, and they supply their taxpayer identification number (TIN).

W-4 Form and Tax Penalties

Employers can be fined certain penalties by the IRS for W-4 form non-compliance. Employers must not make any unauthorized addition or change to the W-4, including altering or omitting any of the language or writing other text on the form. Doing so can result in the W-4 being invalid.

Not calculating the tax withholdings to pay less income taxes carries with it stiff fines. The IRS will penalize employers, “2% of the short-term federal funds rate.”

But that’s not all.

“In the first quarter of 2024, the interest rate for annual underpayments is 7% for companies and 9% for workers who intentionally falsify their W-4. Penalties are determined by multiplying the unpaid tax by the quarterly interest rate.”

Ensure Accurate W-4 Tax Withholding

Government tax forms, including the W-4, are important for the correct processing of federal income taxes for U.S. employees. This includes using and completing the W-4 correctly, ensuring timely processing, and storing the form securely.

For expert advice on W-4 filing and US payroll, talk to Horizons about our United States Employer of Record solution.

Frequently asked questions

The IRS provides W-4 forms in accessible formats, including braille, large print, audio and electronic formats.

Employers are not required to file the W-4 form with the IRS, as it is an internal payroll form. However, the IRS can request copies of an individual’s W-4 if there are questions about tax deductions or the company is under investigation for underpayment.